what to do if tax return is rejected

If your return is rejected at the end of the filing season you have 5 days to correct any errors and resubmit your return. You should take steps to protect your finances and credit and clear up the status of your rejected tax return with the IRS.

What To Do When Your Tax Return Is Rejected Credit Karma Tax

If your e-filed return is rejected because of a duplicate filing under your Social Security number or if the IRS instructs you to do so complete IRS Form 14039 Identity Theft Affidavit PDF.

. No one likes rejection especially when it comes in the form of a rejected tax return. In most cases if your electronic tax return gets rejected initially by the IRS you will have an opportunity to correct the return and retransmit it. Filed late last year after mid-November or your return was processed after that timetry entering 0.

The IRS doesnt tend to reject returns that. Whether you received an error code or not to find out the cause of your rejected tax return youll need to review the paperwork you filed. This is easier if you do have an.

Note that when you file a paper return it can take six to eight weeks for the IRS to process. Review Your Return. If your return was rejected because a return was already filed with your Social Security number that could mean you were a victim of identity theft.

The IRS can levy penalties and interest on your tax account if youre tardy with your tax returns. I know the federal tax subtraction calculation is wrong because the 3rd stimulus isnt deducted so maybe they are now rejected all Oregon returns until they fix it but thats just a guess. Tax season has started and the IRS will reject some tax returns.

19 - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. Spelling and typo errors can be quick and easy to correct. Usually it requires a simple correction of a birth date a Social Security Number or a.

Use a fillable form at IRSgov print then attach the form to your return and mail your return according to instructions. Having your tax return rejected isnt necessarily an immediate cause for concern. How to Speed Up the Process.

File a paper return. To fix and refile your return select Fix it now or Revisit and TurboTax will guide you through fixing and refiling your return. To fix your rejected return first find your rejection codeit indicates the reason your return was rejected.

Changing your status in the software is not going to help--because the IRS will continue to reject the return. The IRS considers your taxes unfiled if the agency rejects your return so its crucial to fix the incorrect details. The code is in the email you received and in TurboTax after selecting Fix my return.

Go to Check Status or Next Steps. Im filling taxes for the first time my return was rejected because theres no record on file. In the event that a rejection comes back after the April 15th tax deadline you will be provided an additional five days to fix the errors and retransmit the return.

But you should figure out why the IRS rejected it and submit a corrected return as quickly and accurately as possible. Ive been telling customers this all season. You havent filed if the IRS rejects your return.

Having issues with your tax return and in tax preparation is common after all it involves so many forms paperwork and precision. Ive filed a half dozen Oregon returns and theyve been accepted but I havent filed for a couple days. The IRS takes 48 hours to intimate the taxpayer about the acceptance or rejection of their tax returns.

The last thing you should do is wait. You can even solve the problem online and send back the electronic file. Tax returns are rejected because a name or number in the tax return does not match the information contained in the IRS databases or the Social Security Administration.

When your return is rejected because of a typographic error or something is misspelled then you can just amend your return and have it submitted again to the IRS. You should also resubmit it before the deadline to avoid incurring penalties. In this case the taxpayer will need to file a paper return and contact the marketplace.

Print out and mail your return claiming your dependent to the IRS. Amended your return last yearmake sure youre using the AGI from your original return not the amended one. But the only way in which you are going to be able to do it without having to bear the brunt of penalties is when you.

Choose Overview at the top of the screen in your HR Block Online product. If your return is rejected you must correct any errors and resubmit your return as soon as possible. You can get a tax return rejected by the IRS for several reasons such as a misspelled name inaccurate information on a dependent or entering an incorrect date of birth.

Prepare e-File and print your tax return right away. Instead contact the IRS or a tax professional immediately figure out why your return was rejected and work with someone to fix the issue. However if you find that all of the information you have entered is.

This is a common rejection Im seeing this tax year. If your return is rejected due to a typo or a misspelling you can fix your return and then re-submit it to the IRS. Find out if youre getting a refund File Your Taxes.

The IRS may delay your refund while the IRS looks into the issue but you should still receive your refund. Choose Details about the Rejection and Fix Issues to correct any. Tax return rejections are typically the result of typos or math errors.

The primary causes of tax return rejection are minor errors like incorrect spelling or identification numbers. People are receiving 1095-As and unaware of them. What to Do If Your Tax Return is Rejected.

Why do tax returns get rejected. If you only have a 1040X form its on line 1 column A.

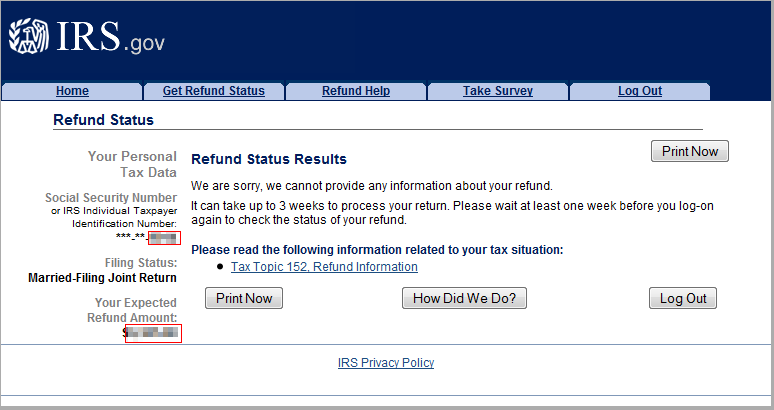

Tax Refund Status Is Still Being Processed

What Happens If Your Bank Rejected Tax Refund Mybanktracker

Why Is It Taking So Long To Get My Tax Refund Irs Processing Delays Continue Causing Direct Deposit Payment Delays Aving To Invest

Tax Return Rejection Codes By Irs And State Instructions

What To Do When Your Income Tax Return Itr12 Is Rejected By Sars On Efiling Due To A Duplicate Irp5 Youtube

Irs E File Rejection Grace Period H R Block

What To Do When Your Income Tax Return Itr12 Is Rejected By Sars On Efiling Due To A Directive Youtube

We Cannot Provide Any Information About Your Refund Where S My Refund Tax News Information

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block